Sep Ira Income Limits 2025

Sep Ira Income Limits 2025. Unfortunately, since a sep ira is a type of traditional ira, you can’t combine a sep ira with a roth ira. 2025 traditional and roth ira contribution limits.

Sep ira employer contributions must be made to a traditional (pretax) ira; 2025 traditional and roth ira contribution limits.

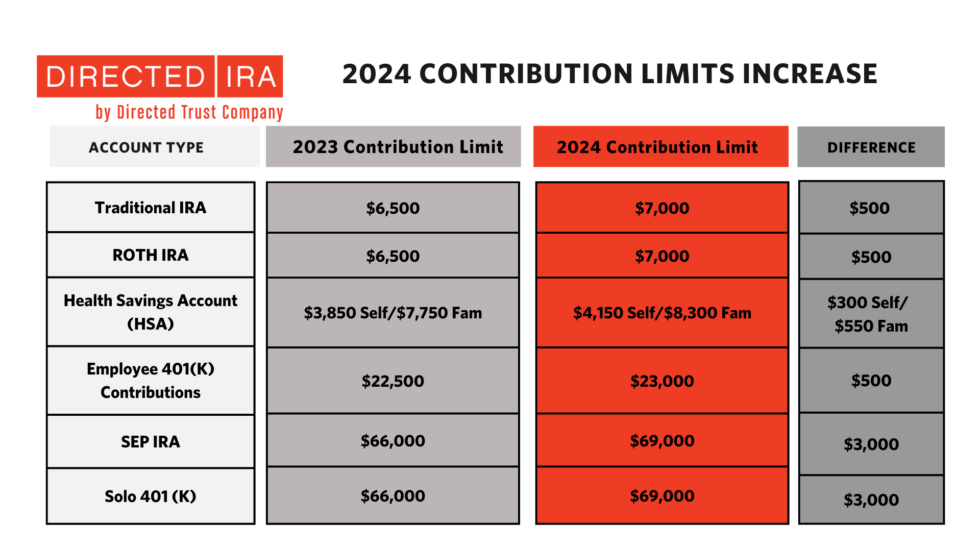

Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

Sep Ira 2025 Contribution Limits Ruthi Clarisse, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older. The maximum compensation that can be considered for.

Sep Ira Contribution Limits 2025 Over 50 Janey Lisbeth, Ira income limits 2025 for sep. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

2025 Contribution Limits Announced by the IRS, Beginning in 2025, the ira contribution limit is. The maximum compensation that can be considered for.

Sep 2025 Contribution Limit Irs Ceil Meagan, That number jumps to $69,000 in 2025. Employers can contribute the lesser of 25% of the employee's annual compensation or $69,000 toward a sep ira in 2025.

Limits For 2025 Image to u, For the year 2025, the contribution limit for a simple ira is $16,000 for. The limit for owners is the lesser of 20% of net income or the.

Sep Ira Contribution Limits 2025 Deadline Dasha Emmalee, You must have earned at least $750. In 2025, income limits are $76,500 for.

Ira Limit 2025 Jeanne Maudie, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Sep ira contribution limits 2025.

2025 ira contribution limits Inflation Protection, Sep ira contribution limits 2025. That number jumps to $69,000 in 2025.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, Ira contribution limits for 2025. Ira contribution limit increased for 2025.

Safe Money Lady™ Navigating the 2025 Retirement Contribution Limits, The contribution limits for a simple ira are lower than for a sep ira. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older.

Those who have a salary reduction simplified employee pension (sarsep) plan that was established before 1997 were entitled to make elective salary deferral.